Excel, a powerful tool offered by Microsoft, has the potential to significantly change the landscape of small business accounting. Despite its seemingly commonplace presence, its extensive capabilities often need to be explored. Leveraging Excel for accounting tasks can not only streamline financial management but also provide valuable insights into business performance.

The tool’s flexibility, accessibility, and scalability make it a cost-effective choice for small businesses looking to optimize their accounting processes. With a basic understanding of its features, one can harness the power of Excel to automate mundane tasks, generate comprehensive financial reports, and make data-driven decisions.

Excel for Financial Calculations

Excel excels in its ability to perform financial calculations ranging from the simple to the complex. At the simplest level, Excel can be used to keep track of income and expenses, providing a clear view of the business’s profitability. However, its power extends far beyond just basic arithmetic.

With Excel, you can create detailed income statements, balance sheets, and even cash flow forecasts. These financial statements provide a snapshot of a company’s financial health, allowing business owners to make informed decisions. For instance, a balance sheet created in Excel can give insights into a company’s assets, liabilities, and equity at a glance.

Moreover, the ‘Excel formulas feature can be used to calculate financial metrics such as net profit margin, gross margin, return on investment, and many more. These metrics are pivotal in assessing a business’s performance and planning for the future. Therefore, Excel’s ability to perform simple and complex calculations makes it an indispensable tool in small business accounting.

Automating Tasks with Excel

Excel’s automation capabilities are truly revolutionary, particularly when harnessed for repetitive tasks such as invoice generation, expense tracking, and payroll calculations. With a well-structured billing template Excel, small businesses can automate their invoicing process, saving valuable time and reducing the risk of human error. Excel allows for automatic updating of invoice numbers, dates, customer information, and more.

Similarly, Excel can be used to track expenses efficiently. By using the SUM function, businesses can easily total their expenses in a given period. Coupling this with the conditional formatting feature can highlight any expenses that exceed a particular threshold, enabling more meticulous financial management.

For payroll calculations, the combination of Excel functions like SUM, COUNT, and AVERAGE can automate much of the process. These functions can calculate total hours worked, overtime, tax deductions, and net pay accurately and efficiently. Therefore, Excel’s automation features can significantly reduce the manual effort involved in these tasks, allowing businesses to focus more on strategic decision-making and growth.

Budgeting and Forecasting with Excel

Excel’s capabilities extend into the realm of budgeting and financial forecasting, making it a powerful tool for strategic planning. Excel can help businesses create detailed budgets that align with their financial goals by meticulously tracking income and expenses.

Businesses can set up a budgeting template in Excel, inputting different categories of income and expenses, and then use formulas to calculate the total revenue, total expenses, and net income. This aids in identifying areas where cost-cutting can be executed and where more investment can be made.

Beyond budgeting, Excel can also be used for financial forecasting. Its trend analysis features, such as linear and exponential trend lines, can help project future financial performance based on historical data.

These forecasts can be further refined using ‘what if’ scenarios, which can help businesses create detailed budgets that align with their financial goals by meticulously tracking income and expenses businesses to evaluate different financial strategies and their potential impact.

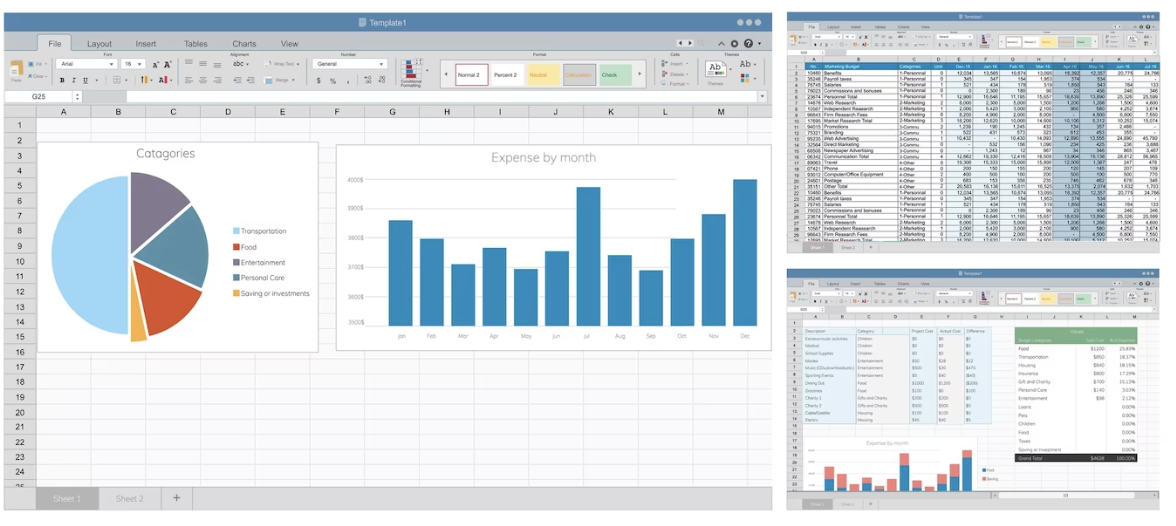

Furthermore, with the data visualization tools available in Excel, such as charts and graphs, businesses can present complex financial data in an easily understandable format. This visual representation of data can help to highlight trends, patterns, or potential issues that may not be immediately apparent from the raw data.

Excel for Risk Management and Compliance

In the realm of risk management and compliance, Excel offers invaluable functionality. It can be used to identify potential financial risks by analyzing trends and inconsistencies in the financial data. For instance, Excel’s conditional formatting feature can highlight values that deviate significantly from the norm, which could indicate potential risks or issues.

Moreover, Excel’s data validation functions can ensure that data entry adheres to certain constraints or conditions, helping to maintain the accuracy and reliability of financial records. This is particularly important for compliance with financial reporting standards, where accuracy is paramount.

Excel also excels in creating and maintaining audit trails, which are essential for compliance purposes. The ‘Track Changes’ function records who made what changes and when creating a record that can be invaluable during audits or internal reviews.

Conclusion

In conclusion, Microsoft Excel is a robust and versatile tool that offers immense value for small businesses, particularly in the realm of accounting. With a well-structured billing template, Excel enables businesses to manage income and expenses, automate tedious tasks, and generate detailed financial reports.

Its capacity for financial forecasting and budgeting aids strategic planning, while its features for risk management and compliance ensure the accuracy and reliability of financial records. As such, Excel is an indispensable asset that empowers businesses to make informed, data-driven decisions, enhancing their efficiency and profitability.